Mana Annual Investment Letter 2019-2020: Abridged

How tall do olive trees grow? It’s a question I ponder a lot as I stare outside my Marina del Rey window to see a beautiful olive tree from my third floor apartment. I’ve googled this on multiple occasions and seem to always find the same result - about 40 feet. But my curiosity continues, because my third floor apartment is on top of a ground level garage and the olive tree is reaching its branches high above our ceiling. With 12-15 feet per story at 4 stories high, the olive tree outside is hitting a solid 50-60 feet tall. I can only guess that it must be that the right conditions are letting this olive tree grow so tall. An endless supply of sunshine as it faces to the west, an annual trim of the branches to remove the parts of the tree that are stunting growth, and a concentrated water supply with sprinklers turning on their faucets any time the ground dries up.

Photo by Ernesto Bruschi on Unsplash

The olive tree outside of my apartment feels much like the market for risk assets this past year.

Instead of sunshine, it’s capital.

Instead of gardeners, it’s market corrections.

Instead of sprinklers, it’s the Fed’s monetary policy of lowering interest rates and buying securities plus the fiscal stimulus from those 2018 tax cuts.

What can we learn from the olive tree? Markets, like trees, don’t die of old age. In fact, the oldest olive tree is estimated to be over 3000 years old! And if the conditions are right, it might just keep growing.

A year in review

It was only about a year ago that the US stock market plummeted 20%, essentially reversing 18 months of positive performance.

Over the past 40 years, the S&P 500 has been down 13% intra-year on average.(1)

When we see outsized corrections, we can’t go back and change them, but we can examine what happened to help better understand the markets and prepare for our future.

Sharp market corrections can’t often be traced to a precise moment, but the research I read and listened to pointed to technical factors that drove this market move. While fundamentals (e.g. economy, corporate earnings, valuations) were mostly intact, the losses in the stock market were largely driven by some of the most liquid names. We will never be sure, but whoever fire sold these stocks had a whole lot of them, which usually indicates the use of leverage. (Think - large hedge fund with big levered positions).

So 2018 ended in a rough patch - down 4%. While market corrections are quite normal, negative calendar years in the S&P 500 have only occurred 27% of the time since 1927 and in more recent history, negative returns in the US are an anomaly. But no matter what you invested in - stocks, bonds, real estate, commodities - you generally lost money in 2018.

So how did we get from dismal 2018 to exciting 2019?

From an economic perspective, there were several things that continued to work in our favor:

Lower taxes (in the US). This drives companies to invest more money into growth or return money to shareholders via share buybacks or dividends. (The latter is what happened).

Lower interest rates. This was a shift from 2018 where expectations were that interest rates might stay flat or rise. We are at 5000 year lows of interest rates after all! Falling interest rates means rising bond prices, as well as the ability for companies, individuals and countries to lower the cost of borrowing capital. If capital is borrowed and invested or spent, companies and countries have the opportunity to continue growing.

Central bank involvement in our markets, including buying securities.

Pointing back to the very tall olive tree - this combination of an infusion of capital (sunshine), the market decline in 2018 (trimming branches) and teetering with interest rates (sprinklers) made for an accretive environment for risk assets to continue to grow.

Why we still believe in investing globally.

Investing globally underperformed investing solely in the US in 2019. This was heightened by a continued US dollar strength. But it’s important to remember that this hasn’t always been the case. The “Lost Decade” - as coined by Warren Buffet - refers to the 10 years between 2000 and 2010 where US investors were not so lucky.

The Power of Staying Diversified

Managing individual money is different than managing money for large institutions. What we aim to do for you is to smooth the ride and continue to provide you with statistics that show you that diversification and patience are statistically expected to pay off over the long haul. While underperforming the S&P 500 can be a frustrating attribute of this investment style, it’s important to recognize that by protecting losses, long term performance is given a better opportunity to prevail. Diversification Means Always Having to Say, “I’m Sorry” (2):

Outside of investments, how else did we add value?

Cristina and I both came from institutional investment management, where fees being charged to our clients were high - sometimes exorbitant. One thing that was important to us was to create a fee structure that is fair for the work we are performing, while considering the overall fees being charged to our clients to ensure it would not be a large drag on performance. We feel confident that our fee structure is competitive and is providing value through a number of ways.

Fee Management: Our highest weighted expense ratio for our portfolios is 0.37% (outside of our income portfolio at 0.42%) and we aim to keep our trading fees to a minimum. While we do not have exact averages of financial advisors more broadly, Bob Veres’ studies show expense ratios, trading costs and platform fees on average for financial advisors range from 0.60% to 0.70%. (3,4)

Tax Management: We have structured our portfolios so tax-efficient assets are held in taxable accounts and tax-inefficient investments are held in qualified accounts (like IRAs, Solo 401ks).

Cash Drag Management: We have institutionalized and operationalized our investment process to ensure that your assets are invested immediately and that the balance of cash in your account, outside of those portfolios who regularly require cash, remains below 0.5%.

Across our client base, what are we hearing?

Over the course of the year, the three greatest desires I have seen in our client base are:

To hold onto their own company stock.

To invest outside of stocks - real estate, bitcoin, private equity, venture capital

Impact investing

Why hold onto a company stock?

People seem to want to hold onto their company stock for a multitude of reasons: to support their company’s mission, they believe they have better information on this stock than other investments, they feel as though the future is bright and it’s not being captured in the market’s pricing of the stock, or because they can’t think of a better alternative. If you picked a winner, this might elevate you to a new level of financial net worth. What were the winners of the last decade?

Ross Stores crushed it, but JCPenney, worth over $80 in 2007 is now worth $1. Valero Energy Corp provided 715% return over the decade, while Exxon - once the largest company in the world - returned +42%. Despite the tremendous housing rally over the past decade, a storage company was the best performing within real estate. After years of gangbusters returns, Macy’s stock price ends the decade only 1% above where it started and luxury retailer Barneys goes bankrupt.

By concentrating your investments you are taking the risk of a single company. Beyond your investments, your income is also tied to this company. If something goes wrong, it will hurt. You might have information by working at the company that gives you insight into the ongoings of the company, but remember that there are CEOs of every public company who are in the same boat.

Everyone wants their company to be the top and many believe they can be, but reality is when there are winners, there are losers.

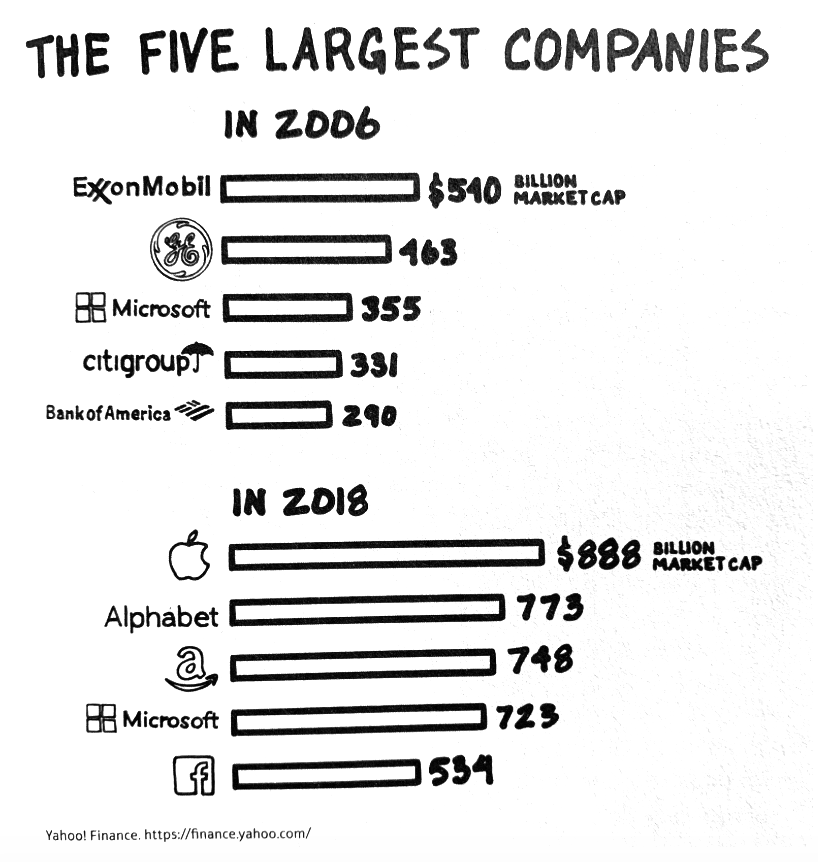

On average, about seven of the 10 largest companies by market value in the S&P 500 underperformed their industry over the following decade by about 7 percentage points, based on research going back to 1997, according to WSJ Market Data Group.

Innosite reports: the rate of creative destruction is accelerating: at the current churn rate, about half of S&P 500 companies will be replaced over the next ten years.

How do we invest outside of stocks?

I am well-aware that there are investments outside of stocks that can make money. This past year was a great example - you could have invested in just about any risk asset and felt like a skilled investor, because you would have made money. Having studied the markets my whole career, I also am well-aware of the market environments that various asset classes perform well and when they do not. But when people say I want exposure other than stocks, what they are really saying is - when the stock market goes down, I don’t want to lose all of my money. (This most often comes out in the form: “I want to buy real estate when it dips.”)

In the hedge fund world, your downside is protected by the nature of the hedges. Concentrated bets can be managed through active hedging. I’ve looked into investing in hedge fund mutual funds and the fees are atrociously high. In our world, your downside is protected by the nature of diversification. It is always our goal to understand the correlations between asset classes and to help find ways to achieve positive performance, while offering more protection on the downside than a typical financial advisor.

What are some examples of these asset classes?

Increased exposure to existing diversifying stocks or bonds

Commodities, including gold

Real Estate

Master-Limited Partnerships

Factor based strategies such as momentum or volatility

Can we invest with impact?

People want to understand how they can contribute by donating their time and money, but another aspect of how we can help is through investing with impact. Impact investing can have a lot of different meanings and there are a number of ways to go about it.

Impact investing has gained a broader audience over the past year and we are excited about it. What we’ve found in the majority of investments is that institutions and ultra high net worth get access to investments by virtue of being qualified purchasers and that in order for us to buy it, we have to pay an extraordinary premium and it’s often embedded with additional risks. There are big financial players including Pimco and Blackrock who are getting deeply involved in this arena, which gives us hope that over the medium term we will be able to implement more impact investing in our portfolios.

Our goal is to incorporate ESG as part of our portfolios. I think we have reached a time where people, even capitalists and big institutions, realize that you can both do good and make money. The challenge in my mind is making sure we are able to access similar country exposure to maintain our global positioning. Emerging and frontier markets are an important component of our long-term growth projections - and for example, by excluding oil & gas companies, we would essentially exclude certain countries, like Brazil. Petrobras, or the Brazilian Petroleum Corporation, represents 40% of Brazil’s stock market.

However it remains important - and so my goal is to find creative solutions to provide you with impact driven asset class exposure without sacrificing performance. More to come!

So what happens next? Where do the roaring 20s take us?

The decade of 2010 to 2020 followed the biggest recession since the Great Depression. But 2010 to 2020 was the first decade since 1850 without a recession. The growth came from an infusion of money from central banks around the world and private capital (private equity, private debt, venture capital) and was ignited with consistent technological innovation across all sectors.

So where do we go from here? If we look around the globe, these are three themes at top of mind as we go forward:

Work smarter, not harder.

We, of the United States, may no longer be the only world superpower.

We’ve only seen the tip of the iceberg in how to do good, while making money.

What does this mean for Mana investment clients?

Fundamentally, this doesn’t change what we do. We are looking at the risk and opportunities prevalent in our economic environment and choosing asset classes that we believe will provide a good balance of risks vs. returns. Remember, statistics show that the vast majority of portfolio returns come from asset class selection, rather than individual securities. We then select fund managers and funds whose exposures are reflective of those asset classes.

Each position in our portfolio has a job description. Our portfolio changes will come if the fund exposures are no longer reflective of the asset classes they should represent in the portfolio, called “style drift”, or if the fund is providing unnecessary risk to the portfolio, either because it is exposed significantly to what we see as a material risk in the market, or if given the market conditions, the position is unlikely to make money. Positions won’t always make money, but the return profile should skew position, while providing good diversification or protection when combined with other positions.

I’d like to close by quoting Bill Gates: “Most people overestimate what they can do in one year and underestimate what they can do in ten years.” Our promise to you is that in the year ahead we will continue to focus on risk management, further operationalizing our investment process and communication to provide you with the same level of service that you would get as an institutional investor or ultra-high net worth investor, and find creative solutions for impact investing and additional diversification in your portfolios. Our goal is to do the leg work for you, educate you, and let you sleep at night so you, too, can maintain a long-term focus to achieve great things over the next decade to come. And who knows, by 2030 that olive tree might have reached 100 feet.

FOOTNOTES

1) Chart from JP Morgan Guide to the Markets. Source: FactSet, Standard & Poor’s, JP Morgan Asset Management. Returns are based on price-index only and do not include dividends. Intra-year drops refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year from 1980 to 2019, over which time the average annual return was 8.9%. Guide to the Markets - US Data are as of January 31, 2020.

2) Source: BlackRock & quote by Brian Portnoy. Source: Morningstar as of December 31, 2018. Past performance is no guarantee of future results. Diversified Portfolio represented by 40% S&P 500 Index, 15% MSCI EAFE Index, 5% Russell 2000 Index, 30% Bloomberg Barclays US Bond Aggregate Index and 10% Bloomberg Barclays US Corporate High Yield Index. Index performance is for illustrative purposes only. You cannot directly invest into an index. Growth from a hypothetical portfolio.

3) Expense ratios were calculated using Y-Charts at the individual security level and aggregating using the target portfolio weights of each of Mana’s models as of December 31, 2019. The fees of actual portfolios may vary if market fluctuations cause the portfolio to vary from the target model. Mana has no control over expense ratios charged by the underlying funds and these may be subject to change. Mana uses no-transaction-fee portfolios for all accounts less than $250k. The highest trading costs are found in Mana’s Income Portfolio. As of December 31, 2019, to buy and sell all securities in this portfolio (called a ‘round trip’) would cost $320.

4) Kitces.com: https://www.kitces.com/blog/independent-financial-advisor-fees-comparison-typical-aum-wealth-management-fee/

Stephanie Bucko is a fee-only financial planner based in Los Angeles, California and is the Chief Investment Officer of Mana Financial Life Design. Mana Financial Life Design provides comprehensive financial planning and investment management services to help clients organize, grow and protect their wealth throughout life’s journey. Mana specializes in advising professionals in the tech industry, as well as women who work in institutional investing, through financial planning and investment management. As a fee-only fiduciary and independent financial advisor, Stephanie never receives commission of any kind. She is legally bound by her certification to provide unbiased and trustworthy financial advice.