2025 Market Review & 2026 Economic Outlook: Emerging Markets, Gold, and the Fed

Asset Class Performance

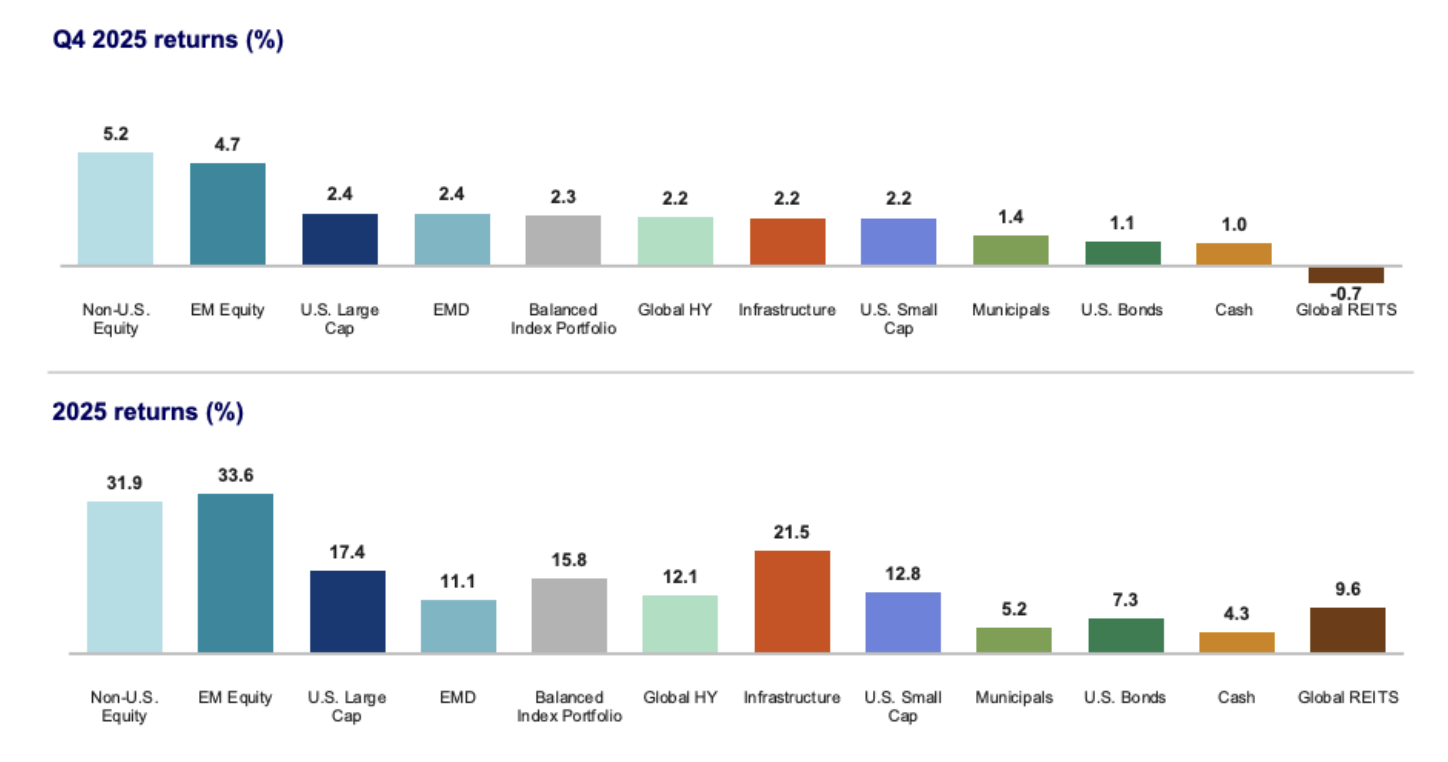

Market performance in 2025 was marked by significant dispersion across regions and asset classes. While broad equity indices finished the year higher, returns varied meaningfully by geography and exposure.

Non-U.S. developed market equities and emerging market equities were among the strongest performers of the year, substantially outpacing U.S. large-cap stocks. That relative strength was also evident during the fourth quarter, reinforcing the role of global diversification within equity allocations. In contrast, fixed income and cash provided more modest, stabilizing returns, while certain real asset categories lagged. The chart below summarizes returns across major asset classes for both Q4 2025 and the full year.

Source: Russell Investments Q4 2025 Economic & Market Review. U.S. Small Cap: Russell 2000® Index; U.S. Large Cap: Russell 1000® Index; Non-U.S.: MSCI World ex-USA Net index; Infrastructure: S&P Global Infrastructure Index; Global High Yield: Bloomberg Global High Yield Index; Global REITs: FTSE EPRA/NAREIT Developed Index; Municipals: Bloomberg Municipal 1-15 Yr. Blend Index, Cash: Bloomberg 1-3 Yr US Treasury Index; EM Equity: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg U.S. Aggregate Bond Index; Balanced Index: 3% U.S. Small Cap,36% U.S. Large Cap,13% Non-U.S., 2% Infrastructure, 4% Global High Yield, 2% Global REITs, 2% Cash, 4% EM Equity, 34% U.S. Bonds. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

Investment Commentary & Outlook

A Strong Market, Many Different Journeys

As we close the books on 2025 and begin the new year, markets are emerging from a period of strength that looked smooth at the index level, but felt very different depending on how portfolios were invested.

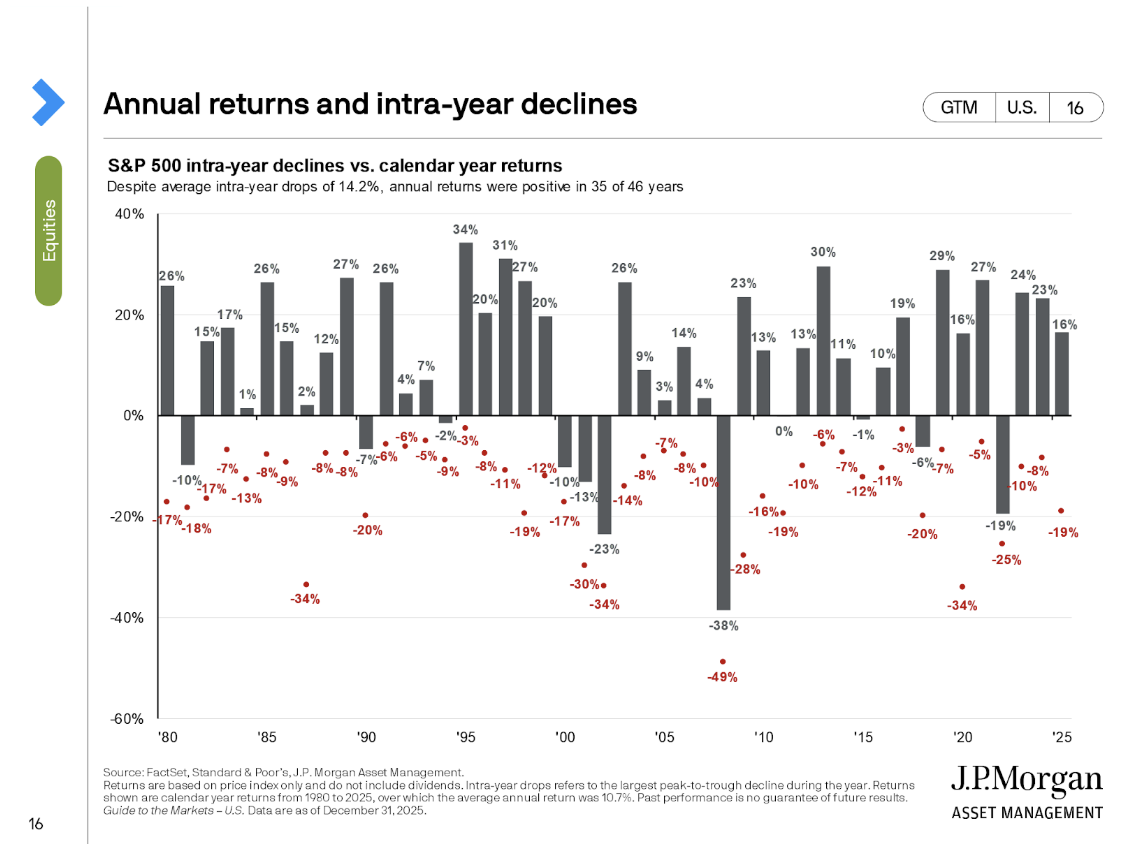

Along the way, markets were tested more than once. A sharper sell-off in April reminded investors how quickly sentiment can shift when uncertainty rises, while a renewed bout of volatility in mid-November reflected ongoing sensitivity to interest rates, valuations, and positioning after a strong run. In both cases, those drawdowns proved short-lived, but they underscored an important point: even in strong years, markets rarely move in a straight line.

By late December, uncertainty eased, selling pressure faded, and markets recovered into year-end. This is a pattern often referred to as the “Santa Claus Rally” where investors reposition and look ahead. What stood out as we entered the new year, however, was not just the recovery itself, but its breadth.

Concentration vs. Diversification For investors holding long-held concentrated positions, the year likely saw continued compounding, but with increasing volatility. In these scenarios, price swings often create the necessary space to have thoughtful conversations about trimming gains - not as a market call, but as a discipline to rebalance risk and turn paper success into realized resilience.

For others, concentrated holdings may have had a more challenging year relative to the broader market. These experiences reinforce an important truth: diversification doesn’t eliminate regret, but it often delivers a smoother ride, helping to keep long-term plans intact across a wider range of outcomes.

Importantly, dispersion also created opportunity. Even in a year when equity markets finished higher, variation across individual stocks provided opportunities to harvest losses—particularly for those contributing consistently or utilizing direct indexing strategies. This kind of implementation work rarely makes headlines, but it meaningfully improves after-tax outcomes over time.

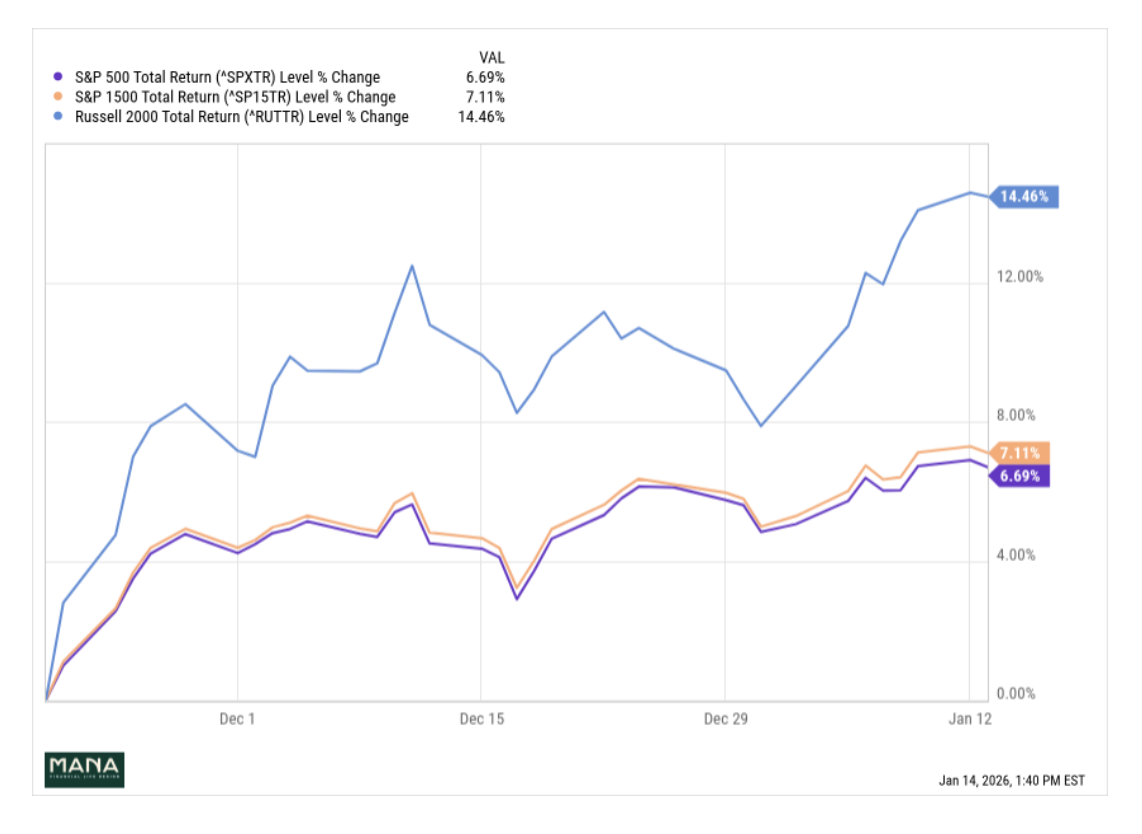

Leadership is Beginning to Broaden

Another notable development as we moved through year-end and into early January was a broadening of market leadership. After a period when returns were dominated by the largest companies, smaller and mid-sized stocks began to outperform, benefiting from easing rate volatility, improving confidence in earnings beyond the largest names, and lighter positioning going into year-end.

This shift reinforces a critical theme for the year ahead: participation matters, but concentration carries its own risks.

Rather than attempting to time leadership changes, a prudent approach remains focused on maintaining diversified exposure that allows portfolios to benefit as market narratives evolve.

Fixed Income Re-Earned Its Role

Interest rates remained an important backdrop in 2025, but the conversation increasingly expanded beyond inflation and growth to include questions of institutional leadership and continuity at the Federal Reserve. While rate volatility was more pronounced earlier in the year, conditions stabilized as inflation continued to moderate and policy moved closer to neutral, even as attention shifted to what comes next for the Fed itself.

Chair Jerome Powell’s term as Fed Chair is expected to conclude in May 2026, though he will remain on the Board of Governors through 2028 to complete his 14 year term. His influence is unlikely to fade quickly. Powell’s credibility, built through the difficult work of bringing inflation down meaningfully without triggering a recession, has made him a steady, trusted voice within the institution. At a time when public confidence in institutions matters, the Fed’s independence and continuity remain an important stabilizing force, even amid political noise.

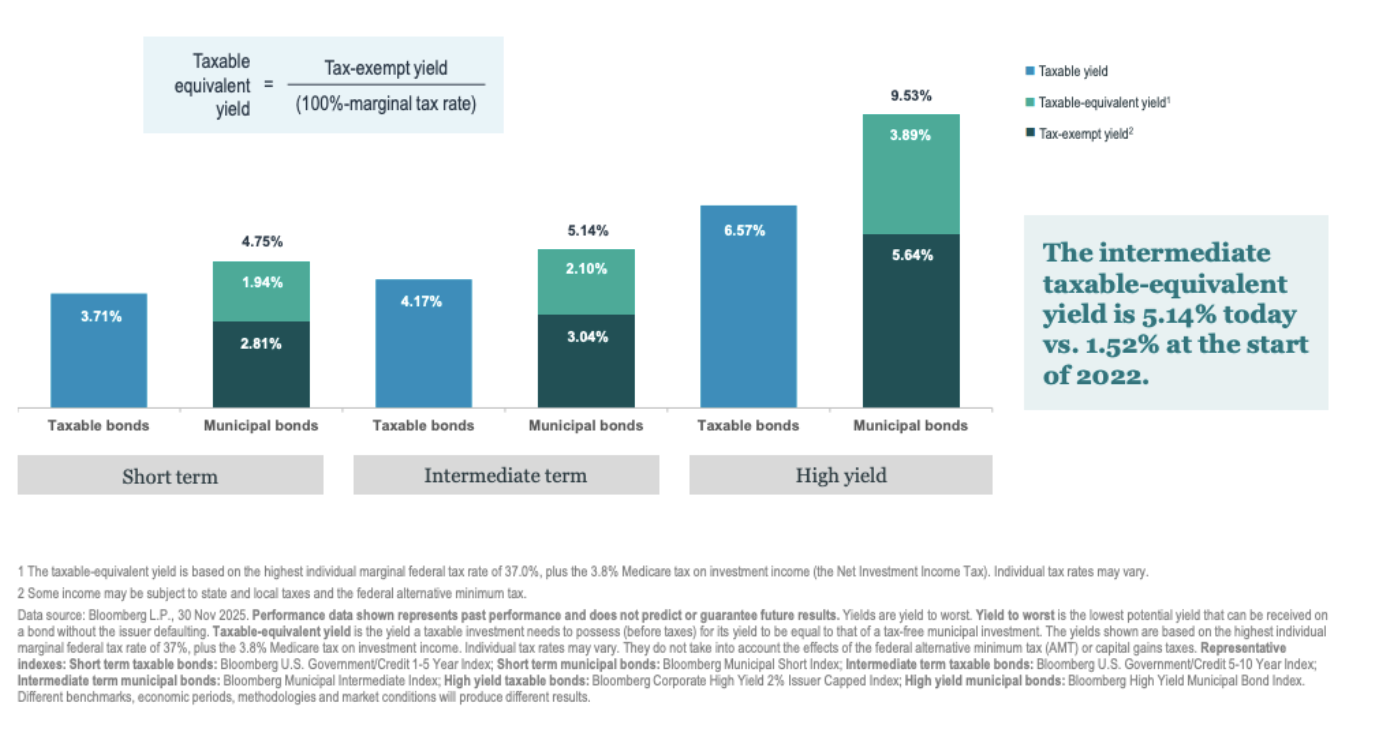

Against this backdrop, higher starting yields have meaningfully improved the role of fixed income in balanced portfolios. Municipal bonds offered attractive after-tax income and diversification benefits, while floating-rate loans provided income with less sensitivity to changes in longer-term interest rates. Rather than attempting to forecast policy shifts, the focus for 2026 is on positioning portfolios to remain resilient through periods of transition.

The chart below, from Nuveen, highlights the tax-equivalent yields available in municipal bonds relative to taxable alternatives for high-income investors.

Themes for Early 2026

1. The Evolution of Emerging Markets. The narrative within emerging markets is shifting. Historically, many portfolios relied on these regions primarily for commodity exposure and resource extraction. However, the growth story in 2026 is increasingly driven by a different set of fundamentals: domestic consumption, technological innovation, and strengthening balance sheets.

For investors, this represents a pivot from "old economy" sectors toward productivity-driven growth. Notably, this evolution aligns naturally with sustainable investing frameworks. By moving away from legacy heavy industries, modern portfolios can capture the rise of the emerging market consumer, aligning financial objectives with the structural changes reshaping the global economy.

2. Alternatives: Gold and Digital Assets Gold and digital assets are solidifying their roles as structural components of a diversified portfolio.

In the current environment, these assets serve a dual purpose. First, they act as potential hedges against monetary expansion and inflation. Second, in periods of systemic disruption, gold has historically offered flight-to-quality protection, while digital assets provide non-sovereign diversification. Rather than trying to time ideal entry points, a disciplined approach focuses on small, strategic allocations designed to build long-term resilience without outsized risk.

Behavioral Finance: Discipline in Good Markets

Periods of strong returns often introduce a different kind of risk. When markets are rising, it becomes easy to confuse momentum with durability, to let allocations drift, or to postpone decisions because discomfort feels unnecessary. In practice, some of the most important portfolio work happens not during periods of stress, but when markets are cooperative.

The past year offered several reminders of this dynamic. Strong headline returns masked meaningful dispersion beneath the surface, while short but sharp pullbacks tested conviction and patience. In that environment, discipline took many forms: rebalancing risk after gains, maintaining diversification even when it lagged, harvesting losses in an up market, and adding diversifiers that felt uncomfortable precisely because recent performance had been strong.

Rebalancing, diversification, and tax management are not reactive tools. They are structural disciplines designed to keep portfolios aligned with long-term goals through a wide range of outcomes, including the ones that feel easiest in the moment.

Markets will continue to evolve, leadership will rotate, and narratives will shift. Our role remains the same: to listen carefully, invest thoughtfully, and help translate market complexity into durable, goal-aligned portfolios that support the lives our clients want to lead.

Follow our Instagram for personal finance tips and inspiration.

Stephanie Bucko and Cristina Livadary are fee-only financial planners based in Los Angeles, California. Stephanie is the Chief Investment Officer and Cristina is the Chief Executive Officer at Mana Financial Life Design (FLD). Mana FLD provides comprehensive financial planning and investment management services to help clients grow and protect their wealth throughout life’s journey. Mana FLD specializes in advising ambitious professionals who seek financial knowledge and want to implement creative budgeting, savings, proactive planning and powerful investment strategies. As fee-only fiduciaries and independent financial advisors, Stephanie and Cristina never receive commission of any kind. Stephanie and Cristina are legally bound by their certifications to provide unbiased and trustworthy financial advice.