Markets, Moves & Mana: Q2 Insights

Markets, Moves & Mana: Q2 Insights

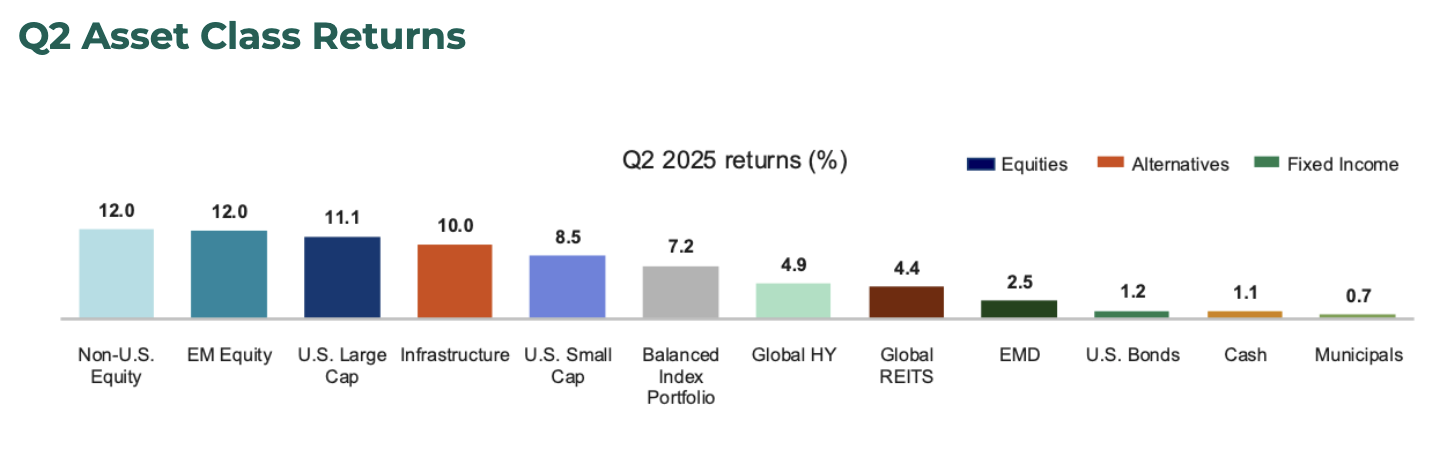

Asset Class Performance

The second quarter of 2025 delivered a strong rebound across risk assets, reversing much of the volatility seen in Q1. After a sharp selloff in April following the announcement of sweeping tariffs on April 2 (“Liberation Day”), both equity and bond markets recovered meaningfully by quarter-end. The S&P 500 gained approximately 11% in Q2, reaching all time highs again at the end of June.

International equities led the way once again. European and Asian markets, bolstered by a weakening U.S. dollar and easing trade tensions with China, posted double-digit gains. The MSCI EAFE Index rose 12% for the quarter, and emerging markets (particularly South Korea and Brazil) delivered similarly strong returns.

Bond markets stabilized despite a volatile yield curve. Long-term Treasury yields rose slightly amid concerns about fiscal deficits and term premiums, while short-term yields declined in anticipation of possible Fed rate cuts later this year. The Bloomberg U.S. Aggregate Bond Index advanced 1.2%, and U.S. high-yield corporate bonds outperformed with returns of 3.5%, aided by resilient credit demand.

Alternative assets also showed strength. Gold continued to climb, fueled by geopolitical risks and inflation concerns. Bitcoin surged over 30% in the quarter, outpacing traditional asset classes and reinforcing its role as a high-risk, high-return diversifier.

Q2 Asset Class Returns

Source: Russell Investments Q2 2025 Economic & Market Review. U.S. Small Cap: Russell 2000® Index; U.S. Large Cap: Russell 1000® Index; Non-U.S.: MSCI World ex-USA Net index; Infrastructure: S&P Global Infrastructure Index; Global High Yield: Bloomberg Global High YieldIndex; Global REITs: FTSE EPRA/NAREIT Developed Index; Municipals: Bloomberg Municipal Index, Cash: FTSE Treasury Bill 3 Month Index; EM Equity: MSCI Emerging Markets Index; U.S. Bonds: Bloomberg U.S. Aggregate

Bond Index; Balanced Index: 3% U.S. Small Cap,36% U.S. Large Cap,13% Non-U.S., 2% Infrastructure, 4% Global High Yield, 2% Global REITs, 2% Cash, 4% EM Equity, 34% U.S. Bonds. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

Investment Commentary & Outlook

The second quarter of 2025 was a study in market resilience. After a steep drawdown in early April, driven by heightened tariff tensions and geopolitical uncertainty, markets staged a powerful rebound. The S&P 500 not only recaptured lost ground but ended the quarter at new all-time highs. This reversal highlights a truth that is often only visible in hindsight: markets can move quickly and decisively, and investors who maintain discipline are often rewarded.

The volatility in April caught many off guard. Equities fell sharply as trade-related headlines dominated the news cycle, interest rates swung dramatically, and consumer sentiment dipped to decade lows. Yet by the end of June, both equity and bond markets had stabilized. What changed? Progress on tariff negotiations with China, steady messaging from the Federal Reserve amid cooling inflation, and a return of investor confidence helped drive the recovery.

If Q1 felt like a test of patience, Q2 rewarded those who stayed the course.

This quarter was also a reminder that diversification and asset allocation remain the most reliable tools in an investor’s toolkit. Asset classes didn’t move in unison. Bitcoin surged, high-yield credit delivered strong gains, and international stocks outperformed in early periods before stabilizing. These crosscurrents show why we continue to emphasize a thoughtfully diversified portfolio—not only across geographies and sectors, but also across traditional and alternative asset classes.

Tariff Policy Update

Markets entered Q2 reeling from the April 2nd announcement of sweeping U.S. tariffs: a 10% baseline on all imports and rates as high as 145% on Chinese goods. Had this come to fruition, it would have been the highest effective tariff levels since before WWII. The move triggered equity selloffs, a spike in volatility, and stalled business investment.

Though initially framed as permanent, the tariffs were partially rolled back under pressure. A 90-day reprieve and progress in U.S.-China talks helped markets recover by quarter-end. Still, the policy whiplash left many companies unable to provide earnings guidance or commit to capital spending.

While inflation has remained contained, the risk of pass-through pricing and slower growth looms. If tariffs persist, the Fed may need to choose between containing inflation or supporting the economy. For investors, the message is clear: policy-driven volatility isn’t going away, and broad diversification remains essential.

Bitcoin as a Portfolio Component

While volatile, Bitcoin has demonstrated long-term resilience. In Q2, it was the best-performing major asset, rising over 30%, well ahead of U.S. stocks, bonds, and gold.

Bitcoin’s recent gains were supported by several structural tailwinds:

Regulatory clarity: The appointment of a pro-crypto SEC chair and growing bipartisan support in Congress have created a more favorable environment for digital assets.

Institutional adoption: Major platforms like Morgan Stanley and Wells Fargo are now enabling access to Bitcoin ETFs. Coinbase, the largest U.S. crypto exchange, joined the S&P 500 in Q2.

Scarcity and demand: Supply remains capped at 21 million coins. At the same time, U.S. spot Bitcoin ETFs purchased more Bitcoin than was mined over the past six months.

We view Bitcoin not as a speculative trade, but as a small, asymmetric allocation designed to enhance portfolio diversification and return potential. Its price movements are largely uncorrelated with traditional markets, offering a distinct return stream that may complement stocks and bonds over time.

Collateralized Loan Obligations (CLOs) as a Portfolio Diversifier

Collateralized Loan Obligations (CLOs), give investors access to high-quality income with built-in protections designed to reduce credit risk. One example illustrates why we find this asset class compelling:

Consider a commercial loan used to support the operations and upgrades of the Century Plaza Towers in Century City, a well-known office complex near Los Angeles’ entertainment and business centers. This loan, along with hundreds of others made to companies across industries, can be bundled into a CLO. These CLOs are then structured into different layers based on risk and return.

The safest part of the CLO is called the AAA-rated layer. Investors in this portion are prioritized in the distribution of income from the underlying loans. In the case of Century Plaza, this means receiving steady income from one of the city’s most iconic office developments, without having to own or manage property or navigate real estate markets directly.

We view AAA CLOs as a modern alternative to traditional bond funds. They combine institutional-grade credit exposure with daily liquidity. Their inclusion in portfolios can enhance income potential and may help reduce reliance on longer-duration bonds that may be more sensitive to interest rate movements.

The Benefits of Staying Invested

Q2 was a powerful reminder of how quickly markets can turn. After sharp declines in April, the S&P 500 bounced back with its strongest monthly return since late 2023, ending the quarter at a new all-time high. For long-term investors, this rebound underscores a timeless lesson: missing the recovery is often more damaging than enduring the decline.

April’s drawdown tested patience. Sentiment plunged, and headlines painted a dire picture. But those who stayed invested were rewarded: The S&P 500 staged one of the quickest comebacks on record, rebounding from its April low to a new high in under 80 days.

Trying to time the market, especially during volatile periods, can have lasting consequences. Research continues to show that missing just a handful of the best days can dramatically reduce long-term returns. This quarter, the third-largest daily gain in market history (+9.5%) occurred on April 9th, just days after Liberation Day.

One of our favorite personal finance writers Morgan Housel sums it up well, "Volatility is the price of admission. The prize inside is superior long-term returns, you have to pay the price to get the returns.” Staying invested through turbulence is one of the most consistent ways to build long-term wealth.

Grounded Strategy in an Uncertain World

The second quarter reminded us that headlines change quickly, but the principles of successful investing remain constant. At Mana, our strategy is built to endure. It is focused on long-term growth, thoughtful risk management, and aligning each portfolio with your goals and values.

Here’s how we’ve continued to act on that strategy this quarter:

Broad Diversification: We maintained exposure across asset classes, including stocks, bonds, and select alternatives. We added positions in Bitcoin and CLOs to expand income and growth potential while managing overall portfolio risk.

Opportunistic Rebalancing: Volatility in April provided a chance to realign portfolios, trimming outperformers and adding to areas where value had emerged.

Tax-Efficient Management: As always, we continue to look for ways to harvest losses, defer gains, and optimize after-tax outcomes.

Client-Centered Advice: We know that investing is never just about the numbers. It’s about making decisions that reflect your life, your family, and your future. Whether you’re preparing for a big transition, adjusting to new goals, or simply checking in, we’re here as your thinking partner.

The months ahead may bring more policy shifts and market noise. Our commitment is to stay grounded in what works: a disciplined process, deep research, and your long-term success. Thank you for your continued trust.

Follow our Instagram for personal finance tips and inspiration.

Stephanie Bucko and Cristina Livadary are fee-only financial planners based in Los Angeles, California. Stephanie is the Chief Investment Officer and Cristina is the Chief Executive Officer at Mana Financial Life Design (FLD). Mana FLD provides comprehensive financial planning and investment management services to help clients grow and protect their wealth throughout life’s journey. Mana FLD specializes in advising ambitious professionals who seek financial knowledge and want to implement creative budgeting, savings, proactive planning and powerful investment strategies. As fee-only fiduciaries and independent financial advisors, Stephanie and Cristina never receive commission of any kind. Stephanie and Cristina are legally bound by their certifications to provide unbiased and trustworthy financial advice.