Get the most out of your credit cards

Travel is back, and has gotten expensive! According to Nerdwallet, prices for travel have risen by 18% since pre-pandemic. It’s no surprise that we’ve been getting lots of questions about what credit cards we recommend, and how to best use points to maximize travel experiences without breaking your budget. If you really want to dive into thriving on points and optimizing using multiple cards, we always love what The Points Guy has to say. Our approach to credit card usage is a little more passive, as we know that money is emotional and can be overwhelming. The good news is that with a little bit of up front work and paying off your statement balance each month, using one point earning credit card consistently will absolutely enhance your travel experiences. In today’s blog, our goal will be to give you a framework for deciding which card is best for you, and inspire you to upgrade your travel like we love to do!

Credit cards are offered by banks, and the biggest credit card issuers are Chase, American Express, Citi, and Capital One. Each of these banks offer tiers of credit cards that range in price and point value. Credit cards have annual fees that range from $0 up to $5,000 for the Centurion American Express Card, but when we’re talking about point comparisons, we’ll narrow it down to the $95-$695/year range. Generally, the higher price you pay the more points you can earn and the higher the point value is in dollars.

Banks offer their flagship products, e.g. Chase Sapphire and American Express, but hotels and airlines also partner with banks to offer cards that provide enhanced benefits for their brand. For example, Chase partners with both United and Marriott, and American Express partners with both Delta and Hilton. Similar to the flagship products, each of these co-branded credit cards offer tiers, where typically a higher annual fee equates to an ability to earn more points.

The highest price credit card isn’t always the most optimal, because the number of points depends on your annual card spend and the categories in which you spend. Your goal with a card that offers points is to pay a fixed fee, and get a higher benefit. Let’s say you are able to earn 30k points in a year based on your spending. At a point value of $0.02 per point, that’s $600, so if you aren’t receiving any other benefit from your $695/year credit card, it wouldn’t be wise to sign up for it. If, however, you’re able to earn 300k points at a $0.02 per point conversion, or $6,000 in benefits, on your $695 card… now we’re talking!

So let’s get started.

To run a cost-benefit analysis, we want to understand both the costs (the annual fee) and the benefit (the dollars we’ll save through points). We’ll talk through two comparative analyses: travel cards under $200 and premium travel cards. We’ll then discuss if you should pick a co-branded card or stick with the flagship product. This is by no way an endorsement for any specific card, but rather the goal should be that you can see how we think about evaluating credit cards, and you can use your own numbers to find out the one that’s best for you. We used The Points Guy Points & Miles Valuation to identify point conversions, but do note that what you use your points on can vastly impact the point conversion. More to come on this! One last note: an important quality to each of the cards we use as examples is that they have $0 in foreign transaction fees. If you’re going to be traveling, we want to make sure you’re not incurring bank fees doing so!

Travel Cards Under $200

The math varies depending on which card you select, and the categories in which you spend, but a good starting point is to determine how much you spend on your credit card on an annual basis. If you’re spending less than $30k, or $2,500/month, we’d recommend sticking to the intro cards.

Our first comparison looks at three cards with great point benefits where the annual fee is below $200/year. We’ve assumed that annual spend is $2,500/month split between travel $1,000/month, restaurants $500/month, shopping $750/month, and $250 for other expenses. We’ll break down each of the benefits using the above budget, with the math as follows: Points earned for category x amount of money spent per month x 12 months.

In this case, Chase Sapphire Preferred and Capital One Venture Card provide very similar ongoing benefits. If you’re brand agnostic as a traveler, the sign on bonus might sway you towards the Capital One Venture Card, as it currently offers 75,000 miles vs. Chase Sapphire Preferred’s sign on bonus of 60,000 points. If you do have specific places that you frequent, or hotel chains that you prefer, double check that your points can be transferred to these brands. For example, if you have family in New Jersey, you visit Germany every year, and your favorite hobby is visiting the mountains outside of Denver… Newark, Frankfurt, Munich, and Denver are all United hubs / major destinations. It would behoove you to select the Chase Sapphire Preferred, because the Capital One card does not transfer to United.

Premium Travel Cards

As the amount of money you spend each year on discretionary spending increases, so does your ability to gain more points, and establish status within airline and hotel brands. We’ll start our analysis in the same way: with an example. We’ve assumed that annual spend is $10,000/month split between travel $3,000/month, restaurants $2,000/month, shopping $3,000/month, uber/lyft $500/month, and $1,500 for other expenses. We’ll break down each of the benefits using the above budget, with the math as follows: Points earned for category x amount of money spent per month x 12 months. With premium cards, there are added benefits that we’ll include in the math, however as you think about this for yourself - evaluate if these are benefits you would actually use.

Wow, wow, wow. Look at those benefits! Again, we’re in a tie-breaker between Chase and Capital One in terms of the amount of benefit expected on an annual basis. However, as you go up in spending and credit card tiers, we’d encourage you to get specific around your brands. If, for example, you’re a Delta flier, we would tell you to go with American Express, despite the lower annual benefit value.

Why should you care about brands? Elite status. In this example, $36,000 per year is being spent on travel, and let’s assume this is for 2 people and half is flights and the other half is hotels. This means $9,000 per person is being spent on flights, and $18,000 on hotels. This is definitely enough money to reap reward benefits and elite status!

As you think through your travel loyalty, we’d encourage you to think about how and where you like to travel. Questions we’d consider:

Is your main airport a hub for any airline? If so, this should very likely be your airline of choice!

If your main airport isn’t a hub, do you frequently visit family or take trips to anywhere that is a hub? If so, choose this one!

When you travel internationally, where do you go? Where do you aspirationally want to go? Use Google Flights to see what airlines and airline networks provide the most direct routes.

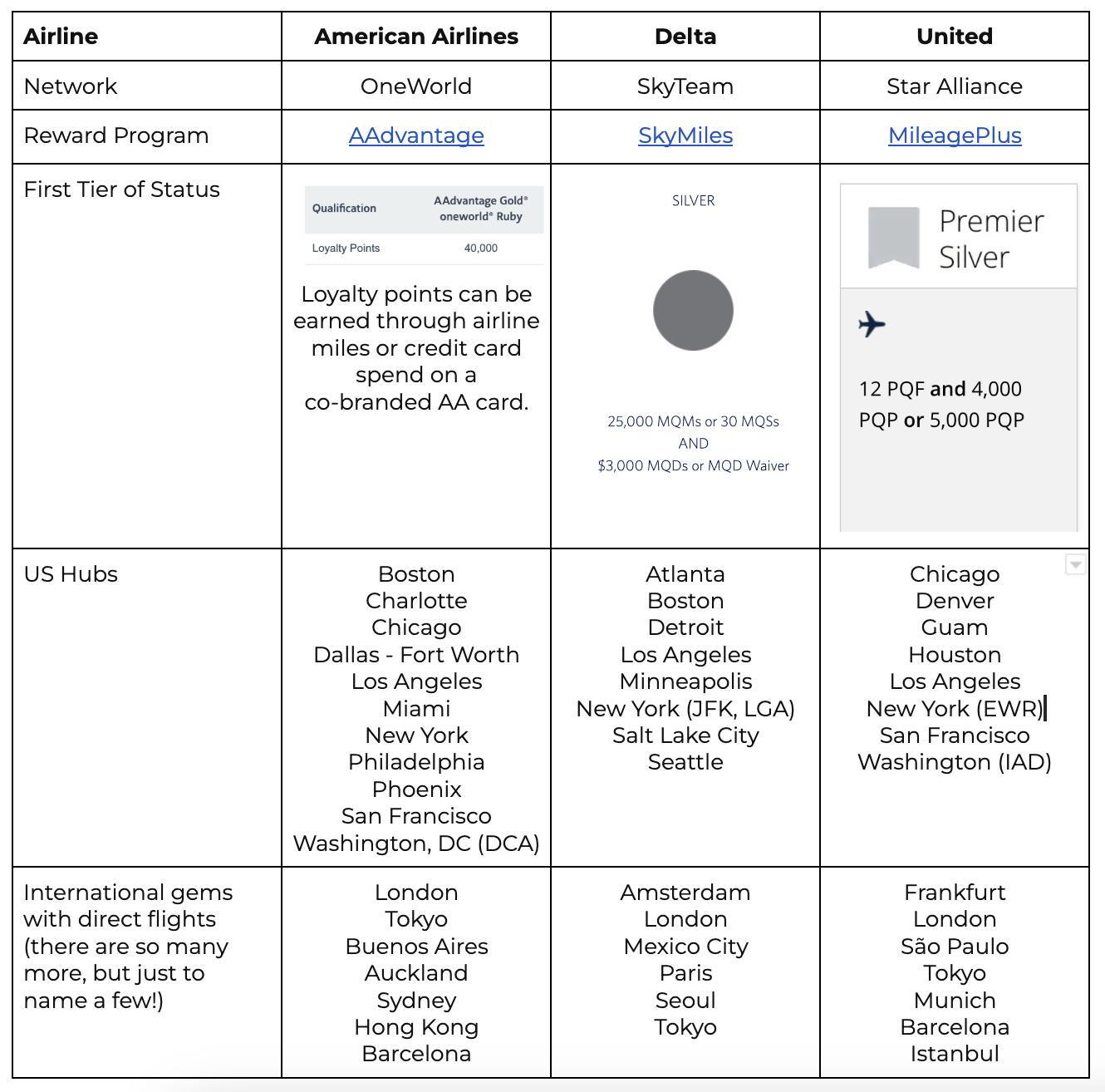

We put together a little summary to get you started, with a focus on United, American, and Delta as they are part of the global networks of airline programs.

If you’re less keen to stick to a specific airline, you can do the same exercise for hotel brands. If you aggregate your expenses to one brand, you’ll rack up enough points to be able to earn status. To earn platinum elite status on each of the top brands (Marriott, Hilton, IHG, and Hyatt), you’ll need to rack up between 40-60 nights staying at a single hotel brand. This is obviously a lot, but the great news is that most of these companies offer ways to fast track.

Now you might be thinking - should I stick with a flagship card, or go with a co-branded card? Our answer: this comes down to your spending. Upgraded Points does a great overview of the co-branded airline cards, but we give you some food for thought below.

If you look at your travel plans, and you realize you’re just short of hitting the status you want on an airline, you might opt for a co-branded card to get you to the next level.

If club access is a priority, and you’re not a Delta flier (Amex Platinum gives you this benefit!), you might opt for the United Club Card or AAdvantage Executive World Elite Mastercard.

The tradeoff to these cards is that in a way, you’re playing a game against yourself. Your goal is to spend as much money (within reason and your budget) as possible supporting this airline, however, the points you receive are miles for this airline. As you spend miles on airline tickets versus paying for them, you’ll receive less points, lowering your overall benefit. If you’re a frequent overseas traveler, and your primary goal for using points / miles is to upgrade to first class, this can get you the best of both worlds - continued spending on your credit card for economy fare tickets, higher likelihood of upgrades because of elite status, and miles for upgrades.

Putting it all together

There is so much to grasp when it comes to deep credit card analysis, but like we said at the beginning, after some up front planning, we take a passive approach. There are people who know how to optimize credit card points way better than we do, but even with some intentionality, you can reap some serious benefits!

Our top three tips to close:

Tip 1: Choose one credit card for the majority of your spending.

We like this strategy, because it’s easier to track your spending when you have everything on one card, and allows you to maximize your optionality for points. It’s generally good for your credit score to have more than one credit card, but we like aggregating most expenses to the card that gives you the most points. We’ve found that some of our clients are most successful in building wealth when they know how much they can spend on their credit card every month. When they overspend this target, it gives them an opportunity to check in, look under the hood, and reflect on the value these expenses provided to their life. Additionally, the more you spend on a card, the greater your point value, and oftentimes there are bonuses for spending a certain amount. When you have a greater point value, you have greater options on how you use your points. Each card will provide unique benefits. Be sure to log into your account and sign up for these benefits, as not all of them are automatically applied to your account. Sometimes this is a one-and-done sign up, and other times on a more frequent cadence. Get used to signing into your account and reviewing the benefits you have available.

Tip 2: Points are only worthwhile if you’re able to pay off your credit card statement balance every month.

Points are typically worth 1-2 cents, and for most of the credit cards we spoke about, you’re earning about 2 points on average for every dollar spent. This means that as you spend, your rate of return is about 4%. A great rate of return for paying off your card on time, but in the case that you rack up credit card debt, points will never be worth it. Most credit card interest rates range from 20-30%, which far outweighs the benefit. Everyone handles their credit cards differently, but one of our favorite methods is to pay off all credit cards on the 1st of every month to start a clean slate. If your credit card statement's due date doesn’t align with the 1st, give your credit card company a call to adjust the due date. We recommend the due date as the 5th of the month so it gives you a little extra leeway in case you forget to login on the 1st.

Tip 3: Never use your credit card points for cash back, use them for experiences.

Not all points are created equal, and not all rewards are equal conversions on points. From our experience, the greatest point value comes from using points to buy or upgrade airline tickets, or purchase hotels. This can be done through your credit card travel portal, or by converting points to airline or hotel points. A good rule of thumb is that 2 cents or more is awesome, but never accept a conversion rate under 1 cent. Outside of monetary benefits, maximum enjoyment is our priority. Professor Elizabeth Dunn from UBC Department of Psychology has taught us many beautiful things about money and happiness, but one of our favorites is that you gain greater happiness when you spend money that you save first, rather than spending and paying for it later. Points are a great way to pay for experiences. You’ve already saved the money (in point form!), and now you get to enjoy the fruits of your labor.

Follow our Instagram for personal finance tips and inspiration.

Stephanie Bucko and Cristina Livadary are fee-only financial planners based in Los Angeles, California. Stephanie is the Chief Investment Officer and Cristina is the Chief Executive Officer at Mana Financial Life Design (FLD). Mana FLD provides comprehensive financial planning and investment management services to help clients grow and protect their wealth throughout life’s journey. Mana FLD specializes in advising ambitious professionals who seek financial knowledge and want to implement creative budgeting, savings, proactive planning and powerful investment strategies. As fee-only fiduciaries and independent financial advisors, Stephanie and Cristina never receive commission of any kind. Stephanie and Cristina are legally bound by their certifications to provide unbiased and trustworthy financial advice.