Mana’s Quarterly Market Update: Q1 2022

Asset Class Performance

Global stocks tumbled in the first quarter of 2022 after a relatively strong fourth quarter of 2021. Just 2 of the 11 S&P sectors posted a positive return over the course of Q1. Energy and Utilities climbed 39.0% and 4.71%, respectively. While Technology, Consumer Discretionary, and Communication Services each fell by more than 8%. Commodities have performed well YTD, and as the only positive asset class of Q1. Emerging Markets were negative once again, for the third consecutive quarter, down -6.9%, and US Growth was the worst performing asset class of Q1 2022.

Extensive research has shown that, if you have a diversified portfolio, a whopping 88% of your experience (the volatility you encounter and the returns you earn) can be traced back to your asset allocation. - Vanguard.

Investment Commentary + Outlook

It’s uncommon that inflation outpaces interest rates. We’ve been in an environment for 40 years where inflation was kept low due to technological innovation and globalization, but the pandemic has shifted this relationship.

The last time this big of a spread between the inflation rate and the 30 year US treasury rate was observed was in 1980, when inflation was 15% and long-term government bonds yielded over 10%. By 1981, mortgage rates reached an all-time high of nearly 17%, but fortunately cash had similar returns on investment. I am reminded of the 30-year CD my great aunt purchased from a small local bank that was offered at 16%.

Cash or bonds, today?

In short, today cash or bonds are allocations meant to protect from extreme market events rather than seek return.

High inflation rates can be bearable if the interest rate on cash is comparable, but that’s not what we’re seeing today. There have been incremental increases in the yield on high yield savings accounts, but nothing near the rates of inflation. As an example, Marcus (a high yield savings account offered by Goldman Sachs) increased their savings rate from 0.5% to 0.6%, but the average US savings account rate still remains at 0.06%.

For bond investors, higher yields mean higher future returns. However, this has come at a cost. The chart on the right shows YTD bond market returns. As you can see, the 1-3 year treasury bond ETF is down 3% YTD, while the 20+ year treasury bond ETF is down over 15%! The longer duration a bond has, the more sensitive it is to interest rate movement.

A simple way to think about it, is for every year of duration, you can expect the price to drop 1% if interest rates rise by 1%. The inverse is true if interest rates fall.

Currently, you’re receiving a similar enough rate of interest whether you’re invested in short term or long term bonds, and if rates continue to rise (which we expect), the losses in longer term bonds will continue.

We expect this rising interest rate environment to persist over the next 1-2 years as the Fed continues to increase short-term benchmark rates. The below chart from Bespoke shows the projected path for interest rates based on futures pricing.

Stock opportunities ahead

Inflation is typically good for the economy, but consistently high inflation can be tough for an economy to keep up with. Last year, inflation picked up and companies were (for the most part) able to pass on higher prices to their customers. But the reality is that individuals had money coming into 2022. There was a significant amount of fiscal stimulus provided to individuals over the last two years, and companies are hiring and paying top dollar for employees.

This trend continues. Wages continue to rise, as does the gap between jobs available (11 million) versus unemployed people (6 million). This puts the power in the employee’s hand.

How we’re seeing this play out in the US stock market dynamics is that companies with higher profitability are being rewarded, as they have greater flexibility to handle the pressures of rising wages and input cost increases. Earnings season for companies is beginning now, and while the outlook points to slower growth than what we’ve seen over the last year, the S&P 500 Index earnings are expected to grow 3.5% over Q1 2021 earnings, on a 10% increase in revenues. International company earnings are also expected to be solid in 2022. In terms of valuations, international stocks have the largest discount to US stocks over the last 15 years, as shown in the chart below from Russell Investments.

The start of the year has been volatile, and we could see this persisting if the Fed hikes rates too quickly or if the war in Ukraine is further escalated by Russia. Although the stock market may be bumpy, we don’t expect to enter a recession during 2022, given the residual amount of stimulus in the system and the increased demand due to re-opening post COVID (leading to growing global GDP). We’ve seen companies supporting this outlook; the team at Yardeni Research analyzed the amount of money used to pay for share buybacks and dividends to shareholders during Q4 2021 for the S&P 500 and its 11 sectors. A company share buyback indicates that a company is willing to pay the current price for their stock, typically a positive indicator. Across the S&P 500, $403 billion was returned to shareholders in the form of buybacks or dividends, an all time high, with technology, consumer discretionary, and real estate leading the way.

Using history as a reflection, data back to 1976 provided by Russell Investments shows below that both stocks and bonds have produced positive returns during periods of Fed tightening.

Staying the course

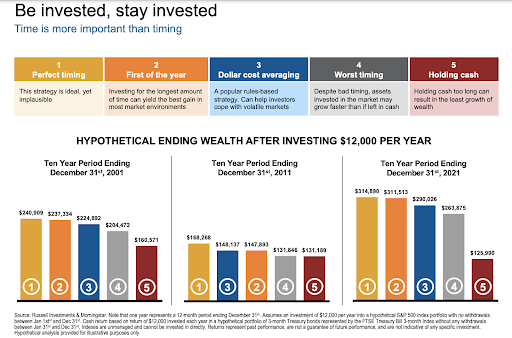

Heading into this year, with interest rates rising and inflation levels higher than we’ve seen for decades, we expected it to be volatile. It is normal and expected for investors’ worries about future returns to increase during times like these. During these times, our role as advisors and guides become even more important. As rates continue to increase, keeping too large of a cash position could have material consequences to your overall rate of return and, thus, your ability to achieve your goals. The question then becomes: given all the market movement, when is a good time to invest? We found the following slide published by Russell Investments to be a very good reminder that time in the market is better than timing the market.

The graphic plots out the path of five different choices an investor can face: timing entry in the market perfectly, investing on the first of the year, dollar cost averaging throughout time on a predetermined schedule, entry in the market at the worst time, and not investing at all (i.e., holding cash).

While there is no doubt that an investor with the ability to predict the absolute low point of entry into the market would outperform all strategies, it’s safe to say that without a crystal ball, history points to options 2 and 3 - investing as soon as you are able or investing via a dollar cost averaging strategy - as the two strategies that would give you the highest probability of a successful outcome.

If you’re ready to invest, our best advice is to continue to clarify your goals and the timing of your goals with your financial advisor. Then turn off your preferred 24-hour news network. Remove as many variables from your decision of when to invest; instead decide whether you’d rather invest all at once or invest a portion on a specific day each month or quarter.

Follow our Instagram for personal finance tips and inspiration.

Stephanie Bucko and Cristina Livadary are fee-only financial planners based in Los Angeles, California. Stephanie is the Chief Investment Officer and Cristina is the Chief Executive Officer at Mana Financial Life Design (FLD). Mana FLD provides comprehensive financial planning and investment management services to help clients grow and protect their wealth throughout life’s journey. Mana FLD specializes in advising ambitious professionals who seek financial knowledge and want to implement creative budgeting, savings, proactive planning and powerful investment strategies. As fee-only fiduciaries and independent financial advisors, Stephanie and Cristina never receive commission of any kind. Stephanie and Cristina are legally bound by their certifications to provide unbiased and trustworthy financial advice.